Furthermore, in remote areas where a lack of traditional bank branches has contributed to scant financial service provision, super-apps enable previously unbanked people to do financial transactions and become part of a wider financial ecosystem.

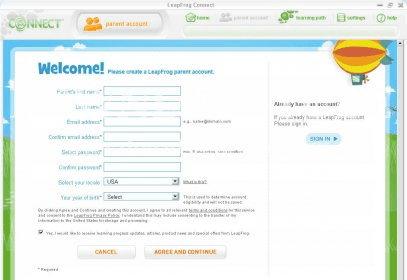

Leapfrog connect software drivers#

Super-apps can be drivers for financial inclusion in the MEA.Super-apps offer an all-in-one platform that requires less bandwidth and data to operate.

In many countries the advent of cheap smartphones has allowed populations to leapfrog desktop technology and adopt mobile apps as their first digital device. Mobile operators have provided the region with affordable low-end smartphones. MEA has historically been the region with the lowest levels of connectivity as well as high fixed-line broadband costs.The prevalence of low-end mobile phones, as well as high internet costs in the MEA, make super-apps an attractive product.The acquisition sums for regional apps – from US$500 million (iFood) to over US$3 billion (Careem), all suggest a valuable market. MTN has introduced person-to-person mobile money payments on its Ayoba app. Firms such as Uber have emerged as local champions, expanding from ride hailing to restaurant delivery.Locally active super-apps are proliferating across the MEA region, but larger cross-regional players remain few.While delving into the MEA region, the study found specific highlights that will enable the rapid growth of super-apps. But more recently firms including Spotify, Uber and Revolut have raced to bundle ever more features into their apps. Consumers in western and MEA markets have largely messaged, hailed taxis, summoned food and paid for things with different apps. While multi-function apps have been popular in Asia for some time, cut-through elsewhere in the world has been slower.

0 kommentar(er)

0 kommentar(er)